Malaysia Car Duty Calculator

SSPN Prime VS SSPN Plus Account. Its simple free and easy.

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Additional costs that might not come up on your duty calculations.

. KRA provide the current Retail Selling Price CRSP for your vehicle. Up to 80 cash back Duties Taxes Calculator to Malaysia. Malaysia Import Duty Calculator.

Fill in tax and price - and get price before tax as result. Use otomy to reach over 2000000 car buyers on Malaysias 1 automotive network. So this puts your car into the 100kW 125kW bracket for the road tax.

9 Must Knows for Malaysia House Purchase FAQ. Car Insurance Calculator East Malaysia Sabah Sarawak Labuan. Do not fill in the currency.

2 of the CIF value. Latest JPJ formula - calculate how much your vehicles road tax will cost. The excise duty import duty VAT and the IDF Fee are all calculated from the customs value.

I propose that all senior citizens with valid driving license and owns a car should be given free road tax up to 2 liter cars and 70 discount from 2 to 299 liter cars. In Malaysia car insurance is compulsory and road tax also has to be paid by car owners. Customs Value is the CRSP value with depreciation applied.

Jabatan Pengangkutan Jalan Aras 3-5 No. Whether the car is diesel or petrol. AmBank Arif Hire Purchase-i.

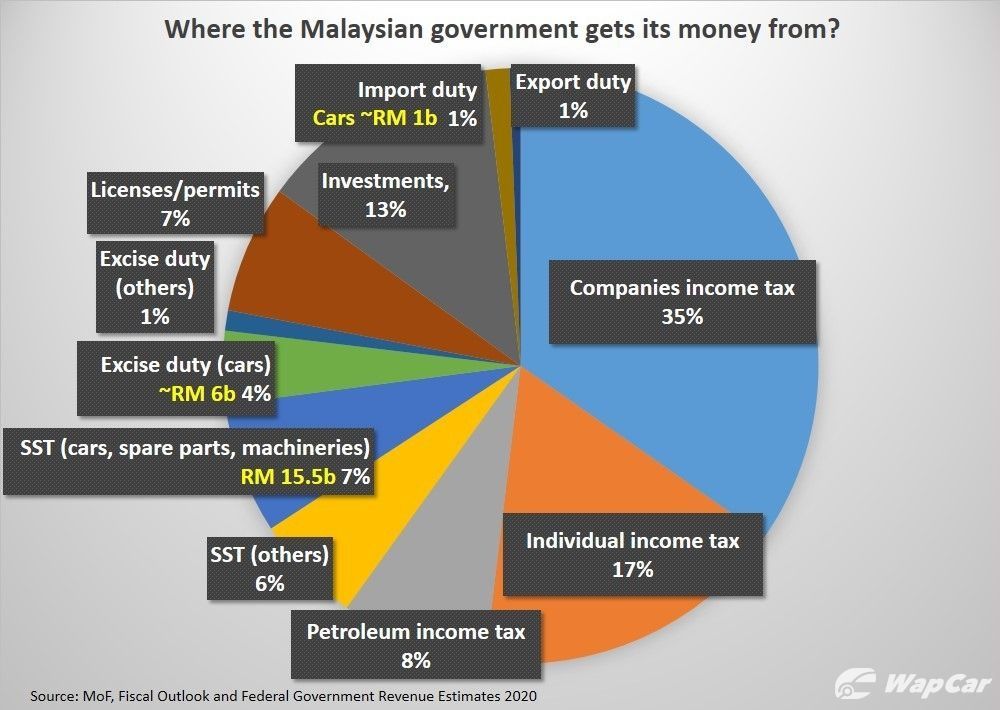

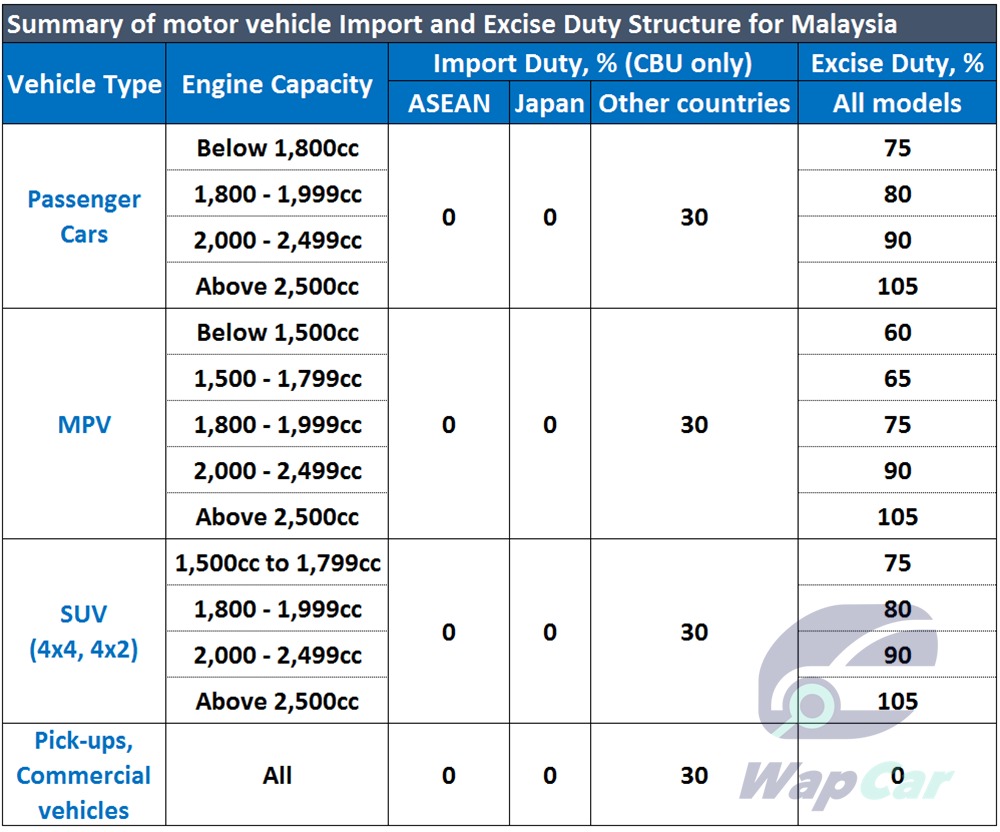

Estimate your tax and duties when shipping from United States to Malaysia based on your shipment weight value and product type. 20 of Customs Value Import Duty VAT. At present the excise duty is set at between 60 to 105 for both locally assembled and imported cars and it is calculated based on the car model and engine capacity.

Every country is different and to ship to Malaysia you need to be aware of the following. 3 Types of Car Insurance in. The calculations done by this calculator is an estimation of Stamp Duty on MOT of house purchase in Malaysia it gives you an idea how much money you.

9 Must-Know Steps for House Purchase Procedure in Malaysia. Afghanistan Albania Algeria American Samoa Andorra Angola Anguilla Antarctica Antigua and Barbuda Argentina Armenia Aruba Australia Austria Azerbaijan Bahamas Bahrain Bangladesh Barbados Belarus Belgium Belize Benin Bermuda Bhutan Bolivia. Tax calculator needs two values.

Price without tax. Exporting from which country. If the full value of your items is over 500 MYR the import tax on a shipment will be 10.

Bank Name Car Loan Interest Rates. Shipping Rates Based On. Start Shipping To Malaysia With Confidence.

Car Insurance Calculator West Malaysia. Calculate import duty and taxes in the web-based calculator. Road tax is used to pay for maintaining the road network nationwide.

Use otomy to reach over 2000000 car buyers on Malaysias 1 automotive network. ComplaintInquiry 60 3 8000 8000 General 60 3 8881 0194 Faks Facebook. Engine Capacity cc Region.

Its fast and free to try and covers over 100 destinations worldwide. Or find your next car amongst the quality listings at otomy. SST Calculator Sales and service tax.

Or find your next car amongst the quality listings at otomy. The larger a vehicles engine the more road tax is payable. Excise Duty is 20 of the Customs Value Import Duty.

Road Tax Calculator Latest JPJ formula - calculate. The amount of road tax depends on the following factors. Last December a news report indicated the possibility that locally-assembled cars could cost more from this year as a result of a potential restructuring of automobile duty rates by.

This sales tax exemption on purchases of new vehicles was previously granted from 15th June 2020 until 31st December 2020 and was further extended by another 6 months to 30 June 2021 by the MoF as an incentive to spur car sales at a time when. You will get a full summary after clicking Calculate button. RM050 progressive rate x 200 RM100.

26 Jalan Tun Hussien Presint 4 Pusat Pentadbiran Kerajaan Persekutuan 62100 WP Putrajaya. You need to fill in two fields. Meanwhile the import duty can go up to 30 which varies based on the vehicles.

This calculation is as follows. Aside from the sales tax vehicles sold are also charged with other taxes namely excise duty and import duty. Youll find prices specifications warranty details high-resolution photos expert and user reviews and so much.

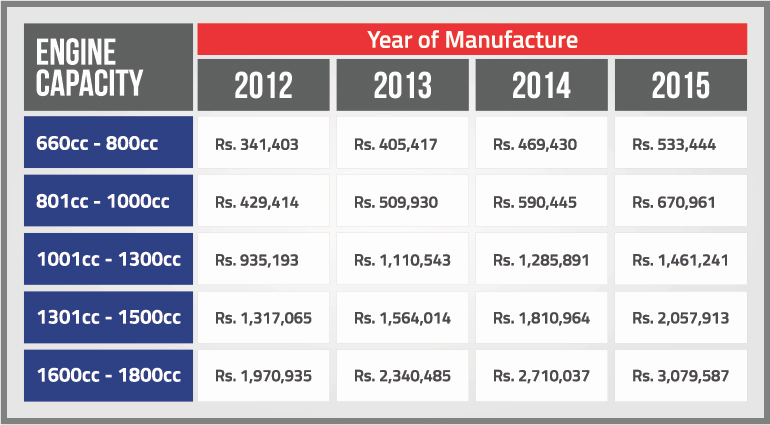

Duty rates for saloons station wagons and Sport Utility Vehicles SUV are based on engine size or cylinder capacity of the vehicle and the year of make. Import Duty is 25 of the Customs Value. In Malaysia sales tax for vehicles has been set at 10 for both locally assembled and imported cars.

Please complete information below. Total road tax. Road Tax Calculator Latest JPJ formula - calculate how much your vehicles road tax will cost.

Alliance Bank Hire Purchase. So register with us. Up to 80 cash back The Tax Free Threshold Is 500 MYR.

35 of the CIF value or Ksh 5000 whichever is higher is payable. Car Ownership Type. RM274 base rate Remaining 10kW.

Below is a table showing different rates of applicable duty on these motor vehicles. 16 of Customs Value Import Duty Excise Duty IDF. Do note that recently in Malaysias Budget 2022 the government has announced that there will be tax-free incentives for EV cars inclusive of road tax.

This calculator calculates the estimated or approximate fees needed for Stamp duty on Memorandum of Transfer MOT. Hire Purchase Car Loan Calculator Malaysia. For example if the declared value of your items is 500 MYR in order for the recipient to receive a package an additional amount of 5000 MYR in taxes will be required to be paid to the destination countries government.

ENGINE CAPACITY CYLINDER CAPACITY CC.

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Custom Duty On Cars In Pakistan Car Import Duty Calculator Pakwheels

Tasc Car Deloitte Company Car Calculator Deloitte Belgium Tax

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Tax Software Mortgage Interest

Car Loan Calculator Malaysia Apps On Google Play

0 Response to "Malaysia Car Duty Calculator"

Post a Comment